- Revenue increases 12% year-over-year to $45 billion; net income ($1.9 billion) and adjusted EBIT ($3.8 billion) also higher; cash and liquidity persistently strong

- Appeal of Ford Pro to commercial customers produces 22% revenue growth; EBIT more than doubles to $2.4 billion, a 15% margin; software, repair services sales up

- Ford Blue gas and hybrid business posts higher wholesales and revenue, reports $2.3 billion in EBIT; all-new global Ranger pickup even more popular, profitable

- Ford Model e revenue up 39%; scaling, competitive pricing further establishing leadership ahead of industry’s next-generation EVs; now expecting to reach 600K run rate in 2024

- Company raises full-year 2023 guidance for adjusted EBIT to between $11 billion and $12 billion, and for adjusted free cash flow to between $6.5 billion and $7 billion

DEARBORN, Mich., July 27, 2023 – Ford showed focus, speed and accountability in producing solid second-quarter 2023 operating results, while taking strategic actions that are expected to help create a high-performing business and long-term value for all stakeholders.

“The shift to powerful digital experiences and breakthrough EVs is underway and going to be volatile, so being able to guide customers through and adapt to the pace of adoption are big advantages for us,” said Ford CEO Jim Farley. “Ford+ is making us more resilient, efficient and profitable, which you can see in Ford Pro’s breakout second-quarter revenue improvement (22%) and EBIT margin (15%).”

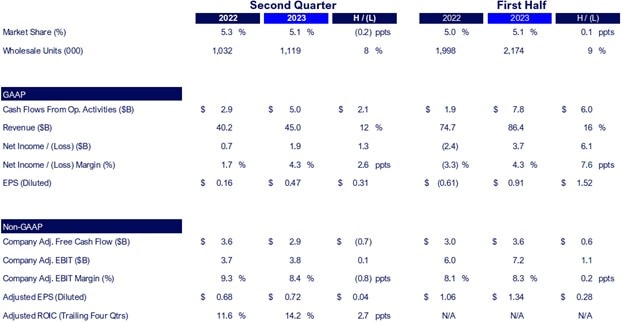

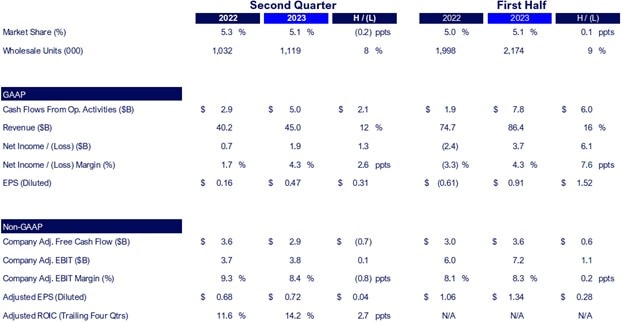

Company Key Metrics Summary

Ford was again America’s top-selling brand in the quarter – net sales increased more than 11% – and for the first six months of 2023. Worldwide, demand for Ford’s fresh lineup of trucks, SUVs and commercial vans pushed second-quarter revenue up 12%, to $45 billion. Quarterly net income was $1.9 billion, nearly three times higher than in the year-ago period and a 4% margin. Adjusted earnings before interest and taxes, or EBIT, grew to $3.8 billion or 8.4% of revenue.

Cash flow from operations and adjusted free cash flow continued to be strong, at $5.0 billion and $2.9 billion, respectively. So was Ford’s balance sheet, with nearly $30 billion of cash and more than $47 billion of liquidity at the end of Q2, both of them up sequentially and year-over-year.

CFO John Lawler reiterated that the company has ample resources to simultaneously fund disciplined investment in growth and return capital to shareholders – for the latter, targeting 40% to 50% of adjusted free cash flow. On July 13, Ford’s board of directors declared the latest regular dividend of 15 cents per share, payable Sept. 1 to shareholders of record at the close of business on July 25.

Business Segment Highlights

In the second quarter, Ford Pro – with a winning combination of vehicles, software and services that generates value for commercial customers and pricing power for Ford – turned 8% growth in product shipments into a 22% jump in revenue. The business unit’s $2.4 billion in EBIT was more than twice its profitability a year ago and represented a 15% margin.

Customer deliveries of the all-new Super Duty work truck had an immediate effect on Ford Pro’s performance, with quarterly U.S. sales of Super Duty up 28%. Global revenue from both gas-powered Transit and electric E-Transit commercial vans was also up.

Commercial customers are also beneficiaries of Ford’s digital innovation and rapidly expanding software and services. Ford Pro accounts for more than 80% of the company’s nearly 550,000 paid software and services subscribers, to date, including solutions for fleet management, telematics and EV charging.

Ford Blue – which engineers, makes and sells highly popular gas and hybrid vehicles, including specialized derivative models – improved its performance in every region.

The appeal and pricing power of Ford Blue’s iconic products helped account for growth in wholesales and revenue, and $2.3 billion in EBIT. Segment initiatives to improve quality and reduce costs are expected to further raise its effectiveness and profitability over time.

In May, Ford Blue and Ford Pro together launched the fully redesigned, highly connected 2024 Ford Ranger. Ranger is a vital part of Ford’s global pickup leadership and is sold in more than 180 markets.

Revenue from Ford Model e’s first-generation electric vehicles increased 39% in the second quarter; sequentially, revenue more doubled.

“The near-term pace of EV adoption will be a little slower than expected, which is going to benefit early movers like Ford,” Farley said. “EV customers are brand loyal and we’re winning lots of them with our high-volume, first-generation products; we’re making smart investments in capabilities and capacity around the world; and, while others are trying to catch up, we have clean-sheet, next-generation products in advanced development that will blow people away.”

Farley said that Ford now expects to reach a 600,000-unit EV production run rate during 2024 and will maintain flexibility, balancing growth and profitability, on the way to attaining a two-million run rate.

Last week, citing increasing production capacity at the Rouge Electric Vehicle Center in Michigan, continued work on cost scaling and improving prices for EV battery raw materials, Ford announced lower suggested retail prices for the all-electric F-150 Lightning pickup truck.

In April, Ford Model e announced a plan to transform Ford’s existing complex in Oakville, Ont., Canada for high-volume EV manufacturing – assembling battery packs and installing them in next-generation electric vehicles produced on the same campus.

Also during the second quarter, the company:

- Opened the Ford Cologne Electrification Center in Germany, its first carbon-neutral factory and home of the forthcoming, all-new Ford Explorer for Europe

- Completed capacity expansion for the Mustang Mach-E in Cuautitlan, Mexico, and initiated another enlargement of the Rouge facility

- Made substantial progress on construction of a next-generation EV pickup plant in West Tennessee, and three joint-venture battery manufacturing facilities in Tennessee and Kentucky, and

- Started site preparation for a wholly-owned plant in Michigan that will produce lithium iron phosphate, or LFP, EV batteries.

The in-company Ford Model e startup is also responsible for advanced digital platforms and software across all Ford product lines. A primary example is the BlueCruise Level 2 advanced driver-assistance system, which through the first half of 2023 had enabled more than 1.4 million hours of hands-free driving for customers across North America.

Ford Credit generated earnings before taxes of $390 million, down from a year ago, as expected, reflecting lower financing margin, the nonrecurrence of credit losses reserve releases and a decline in residual values of leased vehicles – all of which were anticipated in the company’s full-year outlook.

Lawler said the Ford+ plan is designed to turn great value for customers into the same for shareholders and other stakeholders by “breaking Ford out of the cycle of low margins and high capital that’s typified traditional automakers for way too long.”

“We’ve got big ambitions, our approach is different from anyone else’s and we’re doubling down where we have competitive advantages – in trucks, SUVs and commercial vans,” he said. “We think doing that, raising quality and lowering costs can earn us the kind of profitable growth and valuation that best-in-class, technology-led industrial companies command.”

Outlook

Ford is lifting its guidance range for full-year 2023 consolidated adjusted EBIT to between

$11 billion and $12 billion. Likewise, the company is raising its expectations for full-year adjusted free cash flow to between $6.5 billion and $7 billion, with capital expenditures of between $8 billion and $9 billion.

The guidance presumes:

- Headwinds including global economic uncertainty and inflationary pressures, higher industrywide customer incentives and continued EV pricing pressure, increased warranty costs, lower past service pension income, exchange rates and costs associated with union contract negotiations, along with

- Tailwinds comprising an improved supply chain, higher industry volumes, upside from the all-new Super Duty and lower commodity costs.

For its transparent, customer-centered business units, Ford now expects full-year EBIT:

- Approaching $8 billion for Ford Pro, more than double in 2022, from significant year-over-year improvement in pricing and volume

- Of about $8 billion from Ford Blue, with higher volumes and stronger mix more than offsetting any potential pricing headwinds, and

- To be a loss of about $4.5 billion for Ford Model e, reflecting the pricing environment, disciplined investments in new products and capacity, and other costs.

Full-year EBT for Ford Credit is anticipated to be about $1.3 billion.

The company plans to report third-quarter 2023 financial results on Thursday, Oct. 26.

# # #

Conference Call Details

Ford Motor Company (NYSE: F) and Ford Motor Credit Company released their 2023 second-quarter financial results at 4:05 p.m. ET on Thursday, July 27. Following the release, at 5:00 p.m. ET, Jim Farley, Ford president and chief executive officer; John Lawler, Ford chief financial officer; and other members of the Ford senior leadership team will host a conference call to discuss the results in the context of the company’s ambitious Ford+ plan for growth and value creation. The presentation and supporting materials will be available at shareholder.ford.com. Representatives of the investment community will be able to ask questions on the call.

Ford Second-Quarter Earnings Call: Thursday, July 27, at 5:00 p.m. ET

Toll-Free: 844.282.4573

International: +1.412.317.5617

Registration Link (option, speeds login): Ford Earnings Call

Webcast: shareholder.ford.com

Replay

Available after 8:00 p.m. ET on Thursday, July 27, and through Thursday, Aug. 3

Webcast: shareholder.ford.com

Toll-Free: (U.S.) 877.344.7529

(Canada) 855.669.9658

International: +1.412.317.0088

Conference ID: 1732240

Webcast: shareholder.ford.com

The following applies to the information throughout this release:

- See tables later in this release for the nature and amount of special items, and reconciliations of the non-GAAP financial measures designated as “adjusted” to the most comparable financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”).

- Wholesale unit and production volumes include Ford and Lincoln brand vehicles produced and sold by Ford or our unconsolidated affiliates and Jiangling Motors Corporation (“JMC”) brand vehicles produced and sold in China by our unconsolidated affiliate. Revenue does not include vehicles produced and sold by our unconsolidated affiliates. Wholesales and revenue exclude transactions between the Ford Blue, Ford Model e and Ford Pro business segments. See materials supporting the July 27, 2023, conference call at shareholder.ford.com for further discussion of wholesale unit volumes.

Cautionary Note on Forward-Looking Statements

Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation:

• Ford and Ford Credit’s financial condition and results of operations have been and may continue to be adversely affected by public health issues, including epidemics or pandemics such as COVID-19;

• Ford is highly dependent on its suppliers to deliver components in accordance with Ford’s production schedule and specifications, and a shortage of or inability to acquire key components, such as semiconductors, or raw materials, such as lithium, cobalt, nickel, graphite, and manganese, can disrupt Ford’s production of vehicles;

• To facilitate access to the raw materials necessary for the production of electric vehicles, Ford has entered into, and expects to continue to enter into, multi-year commitments to raw material suppliers that subject Ford to risks associated with lower future demand for such materials as well as costs that fluctuate and are difficult to accurately forecast;

• Ford’s long-term competitiveness depends on the successful execution of Ford+;

• Ford’s vehicles could be affected by defects that result in delays in new model launches, recall campaigns, or increased warranty costs;

• Ford may not realize the anticipated benefits of existing or pending strategic alliances, joint ventures, acquisitions, divestitures, restructurings, or new business strategies;

• Operational systems, security systems, vehicles, and services could be affected by cyber incidents, ransomware attacks, and other disruptions and impact Ford and Ford Credit as well as their suppliers and dealers;

• Ford’s production, as well as Ford’s suppliers’ production, and/or the ability to deliver products to consumers could be disrupted by labor issues, natural or man-made disasters, adverse effects of climate change, financial distress, production difficulties, capacity limitations, or other factors;

• Ford’s ability to maintain a competitive cost structure could be affected by labor or other constraints;

• Ford’s ability to attract and retain talented, diverse, and highly skilled employees is critical to its success and competitiveness;

• Ford’s new and existing products and digital, software, and physical services are subject to market acceptance and face significant competition from existing and new entrants in the automotive and digital and software services industries and its reputation may be harmed if it is unable to achieve the initiatives it has announced;

• Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in the United States;

• With a global footprint, Ford’s results could be adversely affected by economic or geopolitical developments, including protectionist trade policies such as tariffs, or other events;

• Industry sales volume can be volatile and could decline if there is a financial crisis, recession, or significant geopolitical event;

• Ford may face increased price competition or a reduction in demand for its products resulting from industry excess capacity, currency fluctuations, competitive actions, or other factors;

• Inflationary pressure and fluctuations in commodity and energy prices, foreign currency exchange rates, interest rates, and market value of Ford or Ford Credit’s investments, including marketable securities, can have a significant effect on results;

• Ford and Ford Credit’s access to debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts could be affected by credit rating downgrades, market volatility, market disruption, regulatory requirements, or other factors;

• The impact of government incentives on Ford’s business could be significant, and Ford’s receipt of government incentives could be subject to reduction, termination, or clawback;

• Ford Credit could experience higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return volumes for leased vehicles;

• Economic and demographic experience for pension and OPEB plans (e.g., discount rates or investment returns) could be worse than Ford has assumed;

• Pension and other postretirement liabilities could adversely affect Ford’s liquidity and financial condition;

• Ford and Ford Credit could experience unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, services, perceived environmental impacts, or otherwise;

• Ford may need to substantially modify its product plans and facilities to comply with safety, emissions, fuel economy, autonomous driving technology, environmental, and other regulations;

• Ford and Ford Credit could be affected by the continued development of more stringent privacy, data use, and data protection laws and regulations as well as consumers’ heightened expectations to safeguard their personal information; and

• Ford Credit could be subject to new or increased credit regulations, consumer protection regulations, or other regulations.

We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, as updated by our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.