- Three customer-focused businesses now drive value, growth: Ford Blue (iconic gas, hybrid vehicles), Ford Model e (breakthrough EVs), Ford Pro (commercial products, services)

- Quarterly revenue rises 20% year-over-year to $41.5 billion; $1.8 billion in net income compares to year-ago net loss of $3.1 billion; adjusted EBIT of $3.4 billion was 45% higher

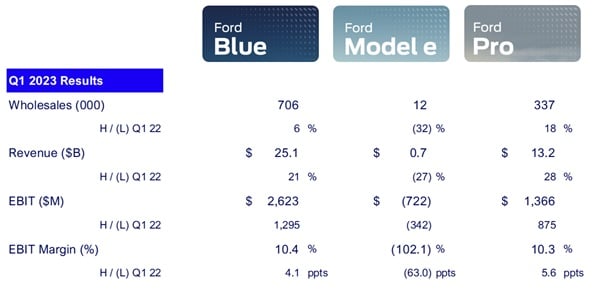

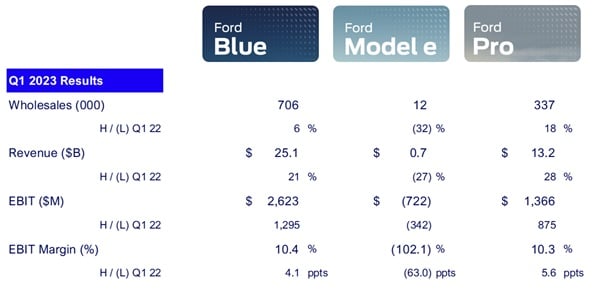

- Ford Pro EBIT nearly triples, to $1.4 billion, and Ford Blue EBIT doubles, to $2.6 billion, with margins for both exceeding 10%

- Company reaffirms guidance for full-year 2023 adjusted EBIT of $9 billion to $11 billion, adjusted free cash flow of about $6 billion

DEARBORN, Mich., May 2, 2023 – According to Ford CEO Jim Farley, the first quarter of organizing around and running the company on behalf of distinct customer groups produced solid operating results and a glimpse of the promise of its Ford+ growth plan.

“We’re bringing Ford+ to life by zeroing in on what distinct customers need and value the most,” said Farley. “Ford Pro is leading the way on profitable growth, our big investments in iconic Ford Blue vehicles and derivatives are winning with customers, and Ford Model e’s different approach to EVs is significantly reducing costs on our first high-volume products while rapidly developing breakthrough next-generation vehicles from the ground up.”

Company Key Metrics Summary

Ford’s first-quarter 2023 revenue reached $41.5 billion, up 20% from the same period a year ago, on shipments approaching 1.1 million vehicles, a 9% increase.

Customers made Ford America’s best-selling vehicle brand in the quarter, choosing its iconic gas-powered, hybrid and electric trucks, commercial vans and SUVs – categories in which the company has demonstrated strengths and made strategic commitments.

Profitability in the quarter was enhanced by a favorable mix of products, higher net pricing and increased volume and was broadly based geographically. The Ford Blue and Ford Pro business segments were both profitable in every region where they operate.

Net income of $1.8 billion compared to a net loss in the 2022 period that was primarily attributable to a change in the mark-to-market value of the company’s investment in Rivian. Company adjusted earnings before interest and taxes, or EBIT, were $3.4 billion, an increase of 45% and margin of 8.1%.

Cash flow from operations in Q1 was $2.8 billion; Ford generated $693 million in adjusted free cash flow. They enabled continued strategic investments in profitable growth and returns to shareholders, including through a regular dividend payable June 1.

At the end of the quarter, the company’s persistently strong balance sheet had nearly $29 billion in cash and more than $46 billion in liquidity. In addition, Ford recently completed the renewal of its more than $17 billion in sustainability-linked corporate credit facilities.

Business Segment Highlights

Ford Blue – which has high expectations for profitable growth from its portfolio of iconic gas-powered and hybrid vehicles – had first-quarter revenue of $25.1 billion, EBIT of $2.6 billion and an EBIT margin of 10.4%, all up sharply from a year ago.

Already the maker of America’s most popular truck for 46 straight years – and top vehicle of any type in the region for 41 years – Ford Blue’s Maverick and Bronco were recognized by Car and Driver among its latest 10 best trucks and SUVs. Mustang was recently named the world’s best-selling sports car over the past 10 years combined, with the seventh-generation, 2024 model coming soon. The segment is also launching new versions of the Ford Escape and Lincoln Corsair SUVs.

Ford Model e, which operates like a startup, is rapidly developing innovative electric vehicles along with breakthrough digital capabilities for deployment across the company’s entire product line. Quarterly shipments of and revenue from EVs were limited by production interruptions of two highly popular vehicles: the Mustang Mach-E SUV, to make industrial changes that will nearly double manufacturing capacity, and the F-150 Lightning pickup, to isolate and address a battery issue before it became a problem for customers.

In March, Ford introduced the new, all-electric Explorer crossover that will be built and sold in Europe – another step toward making and selling EVs at a global run rate of 600,000 units by the end of 2023 and more than two million by the end of 2026.

Disciplined capital investments are boosting capacity of popular EVs like the Mustang Mach-E,

F-150 Lightning and E-Transit. Additionally, Ford Model e will manufacture its next-generation electric pickup at the BlueOval City mega-campus now rising in Stanton, Tenn.; transform an existing operation in Oakville, Ont., Canada, to produce batteries and next-generation EVs; and construct and staff an LFP battery plant in Marshall, Mich.

Meanwhile, Ford Pro, which helps commercial customers transform their enterprises with tailored gas, hybrid and electric vehicles and high-value services, posted 18% growth in wholesales; 28% higher revenue, to $13.2 billion; EBIT of $1.4 billion, nearly three times the 2022 level; and an EBIT margin of 10.3%.

The foundation for Ford Pro’s growth ambitions is made up of market leadership, scale and customer knowledge. Ford’s Transit and E-Transit together remain the top commercial van in both North America and Europe. Nine of the vehicles it sells, including Transit, E-Transit and Super Duty pickups – more than from any automaker – recently earned “Vincentric Best Fleet Value in America” awards.

On top of that substantial base, Ford Pro is layering an ecosystem of software, services and EV charging. Paid software subscriptions increased 64% year-over-year in the first quarter and higher-revenue services were also up strongly. The numbers of mobile repair orders from commercial customers and vans now on the road delivering related services to them both more than doubled from a year ago.

As anticipated, Ford Credit’s earnings before taxes of $303 million were down from last year as a result of a lower financing margin, increased credit losses and a decline in leasing income. The company’s credit-loss performance remains strong and below its historical average, but is trending upward toward more normal levels. Likewise, auction values are also still strong, though down from their peak in the first half of 2022.

Outlook

Ford is maintaining the full-year 2023 performance expectations that the company first articulated in early February: for adjusted EBIT of $9 billion to $11 billion and adjusted free cash flow of about $6 billion.

Additionally, the company reaffirmed 2023 segment-level EBIT expectations: about

$7 billion for Ford Blue, up modestly from last year; a full-year loss of about $3 billion for

Ford Model e; and EBIT approaching $6 billion for Ford Pro, which would be nearly twice its 2022 earnings.

Ford’s operating targets presume a range of puts and takes:

- Headwinds including economic uncertainty around the globe; higher industrywide customer incentives, as vehicle supply-and-demand rebalances; a lower profit from Ford Credit; lower past service pension income; exchange rates; and growth-related investments, e.g., in customer experience, connected services and capital expenditures, and

- Tailwinds such as supply chain improvements and higher industry volumes; launch of the all-new Super Duty truck; and lower costs of goods sold, including for materials and commodities.

Ford will host its next capital markets event here on May 21 and 22, during which it will update investors, analysts and others on the Ford+ strategy, including key performance indicators and financial targets for each of the business segments. The company plans to report its second-quarter 2023 financial results on Thursday, July 27.

# # #

Conference Call Details

Ford Motor Company (NYSE: F) and Ford Motor Credit Company released their 2023 first-quarter financial results at 4:05 p.m. ET on Tuesday, May 2. Following the release, at 5:00 p.m. ET, Jim Farley, Ford president and chief executive officer; John Lawler, Ford chief financial officer; and other members of the Ford senior leadership team will host a conference call to discuss the results. The presentation and supporting materials will be available at shareholder.ford.com. Representatives of the investment community will be able to ask questions on the call.

Ford First-Quarter Earnings Call: Tuesday, May 2, at 5:00 p.m. ET

Toll-Free: 844.763.8274

International: +1.412.717.9224

Registration Link (option, speeds login): Ford Earnings Call

Webcast: shareholder.ford.com

Replay

Available after 8:00 p.m. ET on May 2 and through May 9

Webcast: shareholder.ford.com

Toll-Free: (U.S.) 877.344.7529

(Canada) 855.669.9658

International: +1.412.317.0088

Conference ID: 1608098

Webcast: shareholder.ford.com

The following applies to the information throughout this release:

- See tables later in this release for the nature and amount of special items, and reconciliations of the non-GAAP financial measures designated as “adjusted” to the most comparable financial measures calculated in accordance with U.S. generally accepted accounting principles (“GAAP”).

- Wholesale unit and production volumes include Ford and Lincoln brand vehicles produced and sold by Ford or our unconsolidated affiliates and Jiangling Motors Corporation (“JMC”) brand vehicles produced and sold in China by our unconsolidated affiliate. Revenue does not include vehicles produced and sold by our unconsolidated affiliates. Wholesales and revenue exclude transactions between the Ford Blue, Ford Model e and Ford Pro business segments. See materials supporting the May 2, 2023, conference call at shareholder.ford.com for further discussion of wholesale unit volumes.

Cautionary Note on Forward-Looking Statements

Statements included or incorporated by reference herein may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements are based on expectations, forecasts, and assumptions by our management and involve a number of risks, uncertainties, and other factors that could cause actual results to differ materially from those stated, including, without limitation:

• Ford and Ford Credit’s financial condition and results of operations have been and may continue to be adversely affected by public health issues, including epidemics or pandemics such as COVID-19;

• Ford is highly dependent on its suppliers to deliver components in accordance with Ford’s production schedule and specifications, and a shortage of or inability to acquire key components, such as semiconductors, or raw materials, such as lithium, cobalt, nickel, graphite, and manganese, can disrupt Ford’s production of vehicles;

• To facilitate access to the raw materials necessary for the production of electric vehicles, Ford has entered into, and expects to continue to enter into, multi-year commitments to raw material suppliers that subject Ford to risks associated with lower future demand for such materials as well as costs that fluctuate and are difficult to accurately forecast;

• Ford’s long-term competitiveness depends on the successful execution of Ford+;

• Ford’s vehicles could be affected by defects that result in delays in new model launches, recall campaigns, or increased warranty costs;

• Ford may not realize the anticipated benefits of existing or pending strategic alliances, joint ventures, acquisitions, divestitures, restructurings, or new business strategies;

• Operational systems, security systems, vehicles, and services could be affected by cyber incidents, ransomware attacks, and other disruptions and impact Ford and Ford Credit as well as their suppliers and dealers;

• Ford’s production, as well as Ford’s suppliers’ production, and/or the ability to deliver products to consumers could be disrupted by labor issues, natural or man-made disasters, adverse effects of climate change, financial distress, production difficulties, capacity limitations, or other factors;

• Ford’s ability to maintain a competitive cost structure could be affected by labor or other constraints;

• Ford’s ability to attract and retain talented, diverse, and highly skilled employees is critical to its success and competitiveness;

• Ford’s new and existing products and digital, software, and physical services are subject to market acceptance and face significant competition from existing and new entrants in the automotive and digital and software services industries and its reputation may be harmed if it is unable to achieve the initiatives it has announced;

• Ford’s results are dependent on sales of larger, more profitable vehicles, particularly in the United States;

• With a global footprint, Ford’s results could be adversely affected by economic or geopolitical developments, including protectionist trade policies such as tariffs, or other events;

• Industry sales volume can be volatile and could decline if there is a financial crisis, recession, or significant geopolitical event;

• Ford may face increased price competition or a reduction in demand for its products resulting from industry excess capacity, currency fluctuations, competitive actions, or other factors;

• Inflationary pressure and fluctuations in commodity and energy prices, foreign currency exchange rates, interest rates, and market value of Ford or Ford Credit’s investments, including marketable securities, can have a significant effect on results;

• Ford and Ford Credit’s access to debt, securitization, or derivative markets around the world at competitive rates or in sufficient amounts could be affected by credit rating downgrades, market volatility, market disruption, regulatory requirements, or other factors;

• The impact of government incentives on Ford’s business could be significant, and Ford’s receipt of government incentives could be subject to reduction, termination, or clawback;

• Ford Credit could experience higher-than-expected credit losses, lower-than-anticipated residual values, or higher-than-expected return volumes for leased vehicles;

• Economic and demographic experience for pension and OPEB plans (e.g., discount rates or investment returns) could be worse than Ford has assumed;

• Pension and other postretirement liabilities could adversely affect Ford’s liquidity and financial condition;

• Ford and Ford Credit could experience unusual or significant litigation, governmental investigations, or adverse publicity arising out of alleged defects in products, services, perceived environmental impacts, or otherwise;

• Ford may need to substantially modify its product plans and facilities to comply with safety, emissions, fuel economy, autonomous driving technology, environmental, and other regulations;

• Ford and Ford Credit could be affected by the continued development of more stringent privacy, data use, and data protection laws and regulations as well as consumers’ heightened expectations to safeguard their personal information; and

• Ford Credit could be subject to new or increased credit regulations, consumer protection regulations, or other regulations.

We cannot be certain that any expectation, forecast, or assumption made in preparing forward-looking statements will prove accurate, or that any projection will be realized. It is to be expected that there may be differences between projected and actual results. Our forward-looking statements speak only as of the date of their initial issuance, and we do not undertake any obligation to update or revise publicly any forward-looking statement, whether as a result of new information, future events, or otherwise. For additional discussion, see “Item 1A. Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022, as updated by our subsequent Quarterly Reports on Form 10-Q and Current Reports on Form 8-K.