Images, video and audio from this Web site are provided without login for the purpose of editorial use only.

You must contact media@ford.com to obtain approval for advertising, marketing or other commercial users.

Ford Media Center

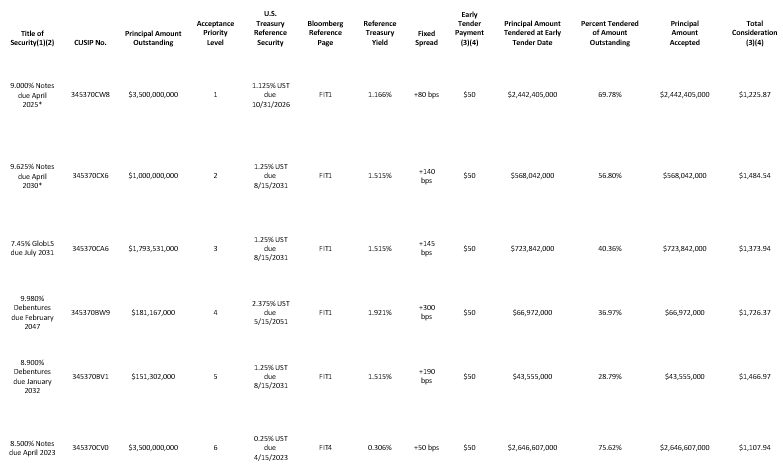

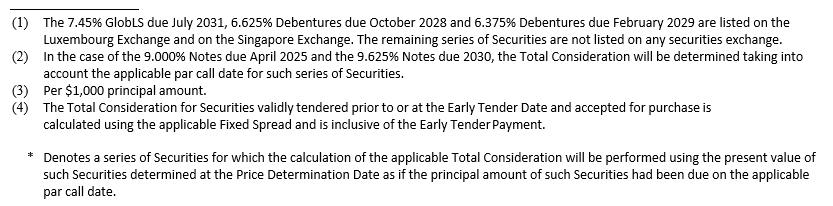

DEARBORN, Mich., November 19, 2021 – Ford Motor Company (“Ford” or the “Company”) announced today the consideration payable in connection with its previously announced cash tender offers (each, a “Tender Offer” and collectively, the “Tender Offers”) to purchase its outstanding 9.000% Notes due April 2025, 9.625% Notes due April 2030, 7.45% GlobLS due July 2031, 9.980% Debentures due February 2047, 8.900% Debentures due January 2032, 8.500% Notes due April 2023, 7.500% Debentures due August 2026, 7.125% Debentures due November 2025, 6.625% Debentures due October 2028 and 6.375% Debentures due February 2029 (collectively, the “Securities”) in the order of priority set forth in the table below (the “Acceptance Priority Level”), subject to an aggregate tender cap of $6,795,510,000 for all series of Securities tendered (the “Aggregate Tender Cap”). Other than with respect to the previously announced upsizing of the Aggregate Tender Cap from $5,000,000,000 to $6,795,510,000, the terms and conditions of the Tender Offers remain unchanged as described in an Offer to Purchase dated November 4, 2021 (as it may be amended or supplemented from time to time, the “Offer to Purchase”).

The table below sets forth, among other things, the aggregate principal amount of Securities tendered as of 5:00 p.m., New York City time, on November 18, 2021 (the “Early Tender Date”), and accepted in each Tender Offer, and the Total Consideration for each series of Securities validly tendered at or prior to the Early Tender Date and accepted for purchase, as calculated at 10:00 a.m. (New York City time) today, November 19, 2021 in accordance with the terms of the Offer to Purchase:

The applicable consideration (the “Total Consideration”) for each $1,000 principal amount of each series of Securities was determined at 10:00 a.m., New York City time, on November 19, 2021.

The Total Consideration offered for the Securities is a price per $1,000 principal amount of each series of Securities validly tendered and accepted for purchase pursuant to the applicable Tender Offer equal to an amount that would reflect, as of the date of purchase, a yield to the maturity date or the par call date, as applicable, determined by reference to the applicable fixed spread for such Securities (the “Fixed Spread”) specified in the table above plus the applicable yield (the “Reference Yield”) based on the bid-side price of the applicable U.S. Treasury Reference Security specified in the table above (as applicable to each series of Securities, the “Reference Security”) as quoted at 10:00 a.m., New York City time, on November 19, 2021, pursuant to the terms set forth in the Offer to Purchase.

Holders of any Securities that are validly tendered prior to or at the Early Tender Date and that are accepted for purchase will receive the applicable Total Consideration. The Total Consideration, as calculated using the Fixed Spread for each series of Securities set forth in the table above, is inclusive of the Early Tender Payment. In addition to the Total Consideration, all Holders of Securities validly tendered prior to or at the Early Tender Date and accepted for purchase pursuant to the Tender Offers will, on November 22, 2021 (the “Early Settlement Date”), also receive accrued and unpaid interest on the Securities from the last interest payment date to, but not including, the Early Settlement Date.

Since the principal amount of Securities tendered and accepted for purchase as of the Early Tender Date is equal to the Aggregate Tender Cap, unless the Company increases the Aggregate Tender Cap prior to 11:59 p.m., New York City time, on December 3, 2021 (such date and time, as it may be extended, the “Expiration Date”), no Securities tendered after the Early Tender Date will be accepted pursuant to the Tender Offers. The Company may increase the Aggregate Tender Cap at any time, subject to applicable law and currently expects that any such increase will be announced after pricing of the Tender Offers.

The Withdrawal Deadline has passed. Accordingly, Securities that have been tendered at the Early Tender Date and any additional Securities that are tendered at or prior to the Expiration Date may not be withdrawn, except in certain limited circumstances where additional withdrawal rights are required by law.

Barclays Capital Inc., BofA Securities, Inc., Mizuho Securities USA LLC, Morgan Stanley & Co. LLC and RBC Capital Markets, LLC are acting as the dealer managers in the Tender Offers. Global Bondholder Services Corporation has been retained to serve as both the depositary and the information agent for the Tender Offers. Persons with questions regarding the Tender Offers should contact Barclays Capital Inc. at (collect) (212) 528-7581 or (toll free) (800) 438-3242, BofA Securities, Inc. at (collect) (980) 683-3215 or (toll free) (888) 292-0070 or (email) debt_advisory@bofa.com, Mizuho Securities USA LLC at (collect) (212) 205-7736 or (toll free) (866) 271-7403, Morgan Stanley & Co. LLC at (collect) (212) 761-1057 or toll free (800) 624-1808 or RBC Capital Markets, LLC at (collect) (212) 618-7843 or toll free (877) 381-2099. Requests for copies of the Offer to Purchase and other related materials should be directed to Global Bondholder Services Corporation at (toll free) (866)-924-2200 or (collect) (212) 430-3774.

None of the Company, its board of directors or officers, the dealer managers, the depositary, the information agent or the trustee with respect to the Securities, or any of their respective affiliates, makes any recommendation that holders tender or refrain from tendering all or any portion of the principal amount of their Securities, and no one has been authorized by any of them to make such a recommendation. Holders must make their own decision as to whether to tender their Securities and, if so, the principal amount of Securities to tender. The Tender Offers are made only by the Offer to Purchase. This news release is neither an offer to purchase nor a solicitation of an offer to sell any Securities in the Tender Offers. The Tender Offers are not being made to holders of Securities in any jurisdiction in which the making or acceptance thereof would not be in compliance with the securities, blue sky or other laws of such jurisdiction. In any jurisdiction in which the Tender Offers are required to be made by a licensed broker or dealer, the Tender Offers will be deemed to be made on behalf of the Company by the dealer managers or one or more registered brokers or dealers that are licensed under the laws of such jurisdiction.

This news release does not constitute an offer to sell, or the solicitation of an offer to sell, or the solicitation of an offer to buy any securities that may be issued pursuant to the transactions described above. Further, nothing contained herein shall constitute a notice of redemption of the Securities of any series.

Ford Motor Company (NYSE: F) is a global company based in Dearborn, Michigan, committed to helping build a better world, where every person is free to move and pursue their dreams. The company’s Ford+ plan for growth and value creation combines existing strengths, new capabilities and always-on relationships with customers to enrich experiences for customers and deepen their loyalty. Ford develops and delivers innovative, must-have Ford trucks, sport utility vehicles, commercial vans and cars and Lincoln luxury vehicles, along with connected services. The company does that through three customer-centered business segments: Ford Blue, engineering iconic gas-powered and hybrid vehicles; Ford Model e, inventing breakthrough electric vehicles along with embedded software that defines exceptional digital experiences for all customers; and Ford Pro, helping commercial customers transform and expand their businesses with vehicles and services tailored to their needs. Additionally, Ford provides financial services through Ford Motor Credit Company. Ford employs about 174,000 people worldwide. More information about the company and its products and services is available at corporate.ford.com.